Typically, a non-banking financial services company will have a very small internal IT team and will be dealing with a lot of data management residing in their loan origination systems, loan management systems pertaining to all the different customer segments they focus upon.

These systems and data are subject to change and when there is a change, there are challenges with the data migration. Hence it makes strategic focus for NBFCs to look for a common data mart that can integrate from different venues, a data mart that can outlast the changes and updates.

There are numerous paths that can be taken. A lot of LMS products offer an analytics platform in built. They come with a cost and customization that might or might not suit the buyer. There are also isolated products where the data is extracted and pushed onto the platform. This option might be time consuming. Looking at these choices might be overwhelming for an NBFC starting out or looking to change or update their current set up.

Fortunately, the array of cloud-based solutions and visualization tools made available by Microsoft, can aid in setting up an agile and cost-effective analytics platform which will prove decisive in the growth of NBFC organizations.

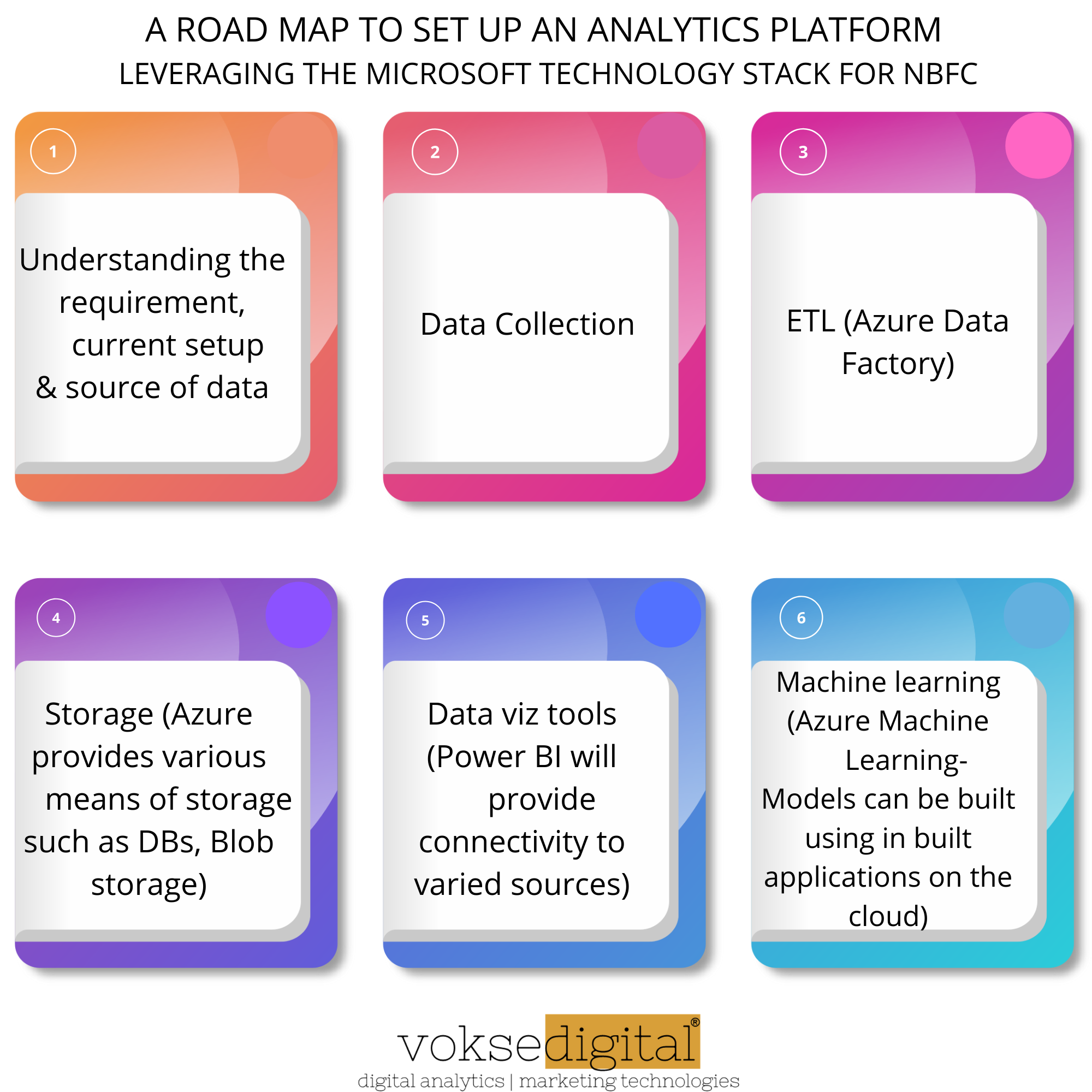

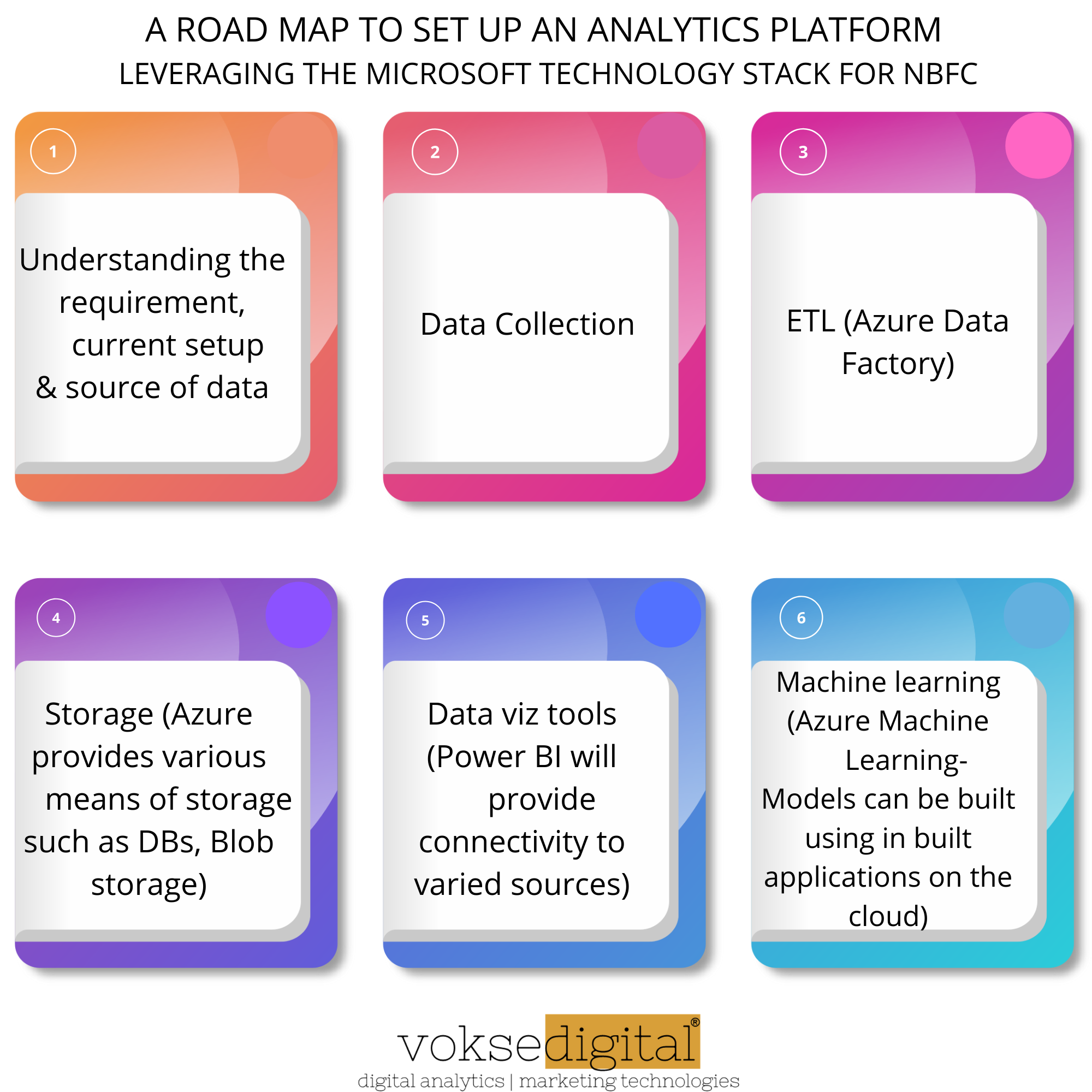

Below a road map to set up an analytics platform leveraging the Microsoft technology stack:

Starting from the understanding why there is a need for a data set up, the identification of inadequacy in all stages of business processes starting from application of loans, disbursal, collection, and further analytics or lack thereof. It also involves vetting of previously existing

- Data acquisition systems be it mobile apps, or any other high-tech LOS/LMS or even a plain vanilla excel sheet

- Data warehouses that can be NoSQL or SQL databases or just a folder on your desktop

- Analytics platform if present, the math and the technology involved.